Percentage of federal income tax withheld per paycheck

The TCJA eliminated the personal exemption. 4868 Application for Automatic Extension of Time To File US.

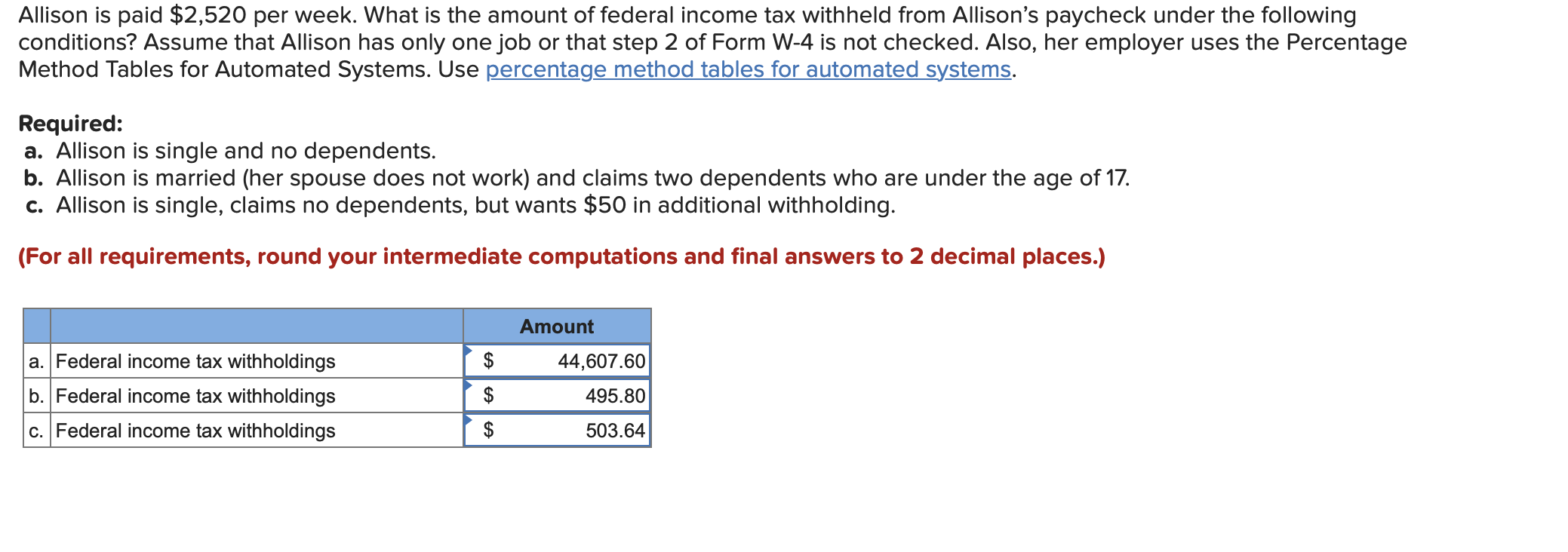

Solved Allison Is Paid 2 520 Per Week What Is The Amount Chegg Com

Who purchase and use HR Block desktop software solutions to prepare and successfully file their 2021 individual income tax return federal or state.

. Nonpayroll items include the following. The table below shows the tax brackets for the federal income tax and it reflects the rates for the 2021 tax year which are the taxes due in early 2022. Complete your federal income tax return Form 1040 US.

Nonpayroll federal income tax withholding reported on Forms 1099 and Form W-2G Certain Gambling Winnings must be reported on Form 945 Annual Return of Withheld Federal Income Tax. If Marthas FIT per pay is 23644 and she wants an additional 20 per pay withheld her FIT per pay would be 25644. This is the percent of your gross income you put into a taxable deferred retirement account such as a 401k or 403b.

California does not conform to IRC section 265 regarding expenses and interest relating to tax-exempt income but instead has stand-alone language that disallows certain deductions related to tax-exempt income. States dont impose their own income tax for tax year 2022. Review and calculate the federal income tax brackets and rates in the US and understand how they apply to you from HR Blocks tax experts.

Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes the employee must pay. Individual Income Tax Return or Form 1040-SR US. All these factors determine the employees federal income tax withholding amount.

The employee can earn a. Tax Return for Seniors before you begin your Form 540 California Resident Income Tax Return. On line 1b record the number of pay periods you have per year using Table 5 on the same page.

Pay an average federal income tax of 93 and 26 of income and Social Security taxes of 83 and 79 of income respectively. Federal income tax rates range from 10 up to a top marginal rate of 37. Use information from your federal income tax return to complete your Form 540.

Choosing not to have income tax withheld. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. Federal income tax is usually the largest tax deduction from gross pay on a paycheck.

Median household income in 2020 was 67340. The impact on your paycheck might be less than you think. 1310 Statement of Person Claiming Refund Due a Deceased Taxpayer.

2555 Foreign Earned Income. When it comes to funding FICA your employee pays 50 from their paycheck while you the employer pay 50 out of your own revenue. Many employees pay taxes through paycheck withholding.

As the employer you are required to withhold and pay. Individual Income Tax Return. 6 7 I claim exemption from withholding for 2019 and I certify that I meet both of the following conditions for exemption.

No as employee you do not have to earn a minimum income for federal and state income tax to be withheld. Theres also the scenario that you had your taxes withheld from your paycheck which means you already paid your taxes. The amount begins to phase out if you have modified AGI in excess of 216660 and is completely phased out if your modified AGI is 256660 or more.

In some cases too much might have been taken out of your paycheck and now the federal government owes you a refund. Calculating federal tax withholding can be surprisingly frustrating even though its something the majority of people have to do regularly. Only the highest earners are subject to this percentage.

While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding. What is the percentage of federal income tax withheld. Income Tax Return for Seniors.

If the corporation had tax withheld under Chapter 3 or 4 of the Internal Revenue Code and received a Form 1042-S Form 8805 or Form 8288-A showing the amount of income tax withheld attach such forms to the corporations income tax return to claim a withholding credit. Unlike the federal income tax system rates do not vary based on income level. 2848 Power of Attorney and Declaration of Representative.

By Congressional Budget Office CBO calculations the lowest income quintile 020 and second quintile 2140 of households in the US. Complete and mail Form 540 by April 18 2022. Rates do increase however based on geography.

Federal Income Tax Withholding Methods For use in 2022. Here you will see tables that detail how much income should be withheld from your paycheck. What most people think of the bonus tax rate is actually a percentage of tax withheld from pay in certain circumstances.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. The employees FIT amount per paycheck of 39039 reduces by 15385 for a new lower FIT of 23644 per pay. Twenty states and the District of Columbia follow the CARES Act in increasing the net interest deduction to 50 percent of modified income for tax years 2019 and 2020.

Additional amount if any you want withheld from each paycheck. But if withholding doesnt apply to you or it wont cover all your tax obligations you may need to pay estimated taxes quarterly. Separate deposits are required for payroll Form 941 or Form 944 and nonpayroll Form 945 withholding.

Ing is included with any other additional tax amounts per pay period in Step 4c. Part 3 of 3. Last year I had a right to a refund of all federal income tax withheld because I.

Federal income tax is based on the employees filing status number of allowancesexemptions earnings and the IRS withholding tax tables. California conforms to IRC section 61 as of the specified date of 112015 with modifications. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

In the case of a payer using the new 2022 Form W-4P a payee who writes No Withholding on the 2022 Form W-4P in the space below Step 4c shall have no federal income tax withheld from their periodic pension or annuity payments. Federal Paycheck Quick Facts. Prizes and awards certain commissions overtime pay back pay and reported.

How to Calculate Federal Income Tax. A 20000 solar system would receive a tax credit of 6000 to what you owe in federal income taxes. Wage bracket example115 withheld.

The adoption credit and the exclusion for employer-provided adoption benefits have both increased to 14440 per eligible child in 2020. ADJUSTED ANNUAL WAGE. In 2022 the federal income tax rate tops out at 37.

The Withholding Form. Non-exempt employees have the opportunity for a bigger paycheck by working over 40 hours per week. Employers use the amount on this line as an an-.

Forgiveness of Paycheck Protection Program PPP loans. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. Only 12 states limit NOL carryforwards such that they may not reduce taxable income by more than a specified percentage per year in tax years 2018 2019 and 2020.

Or decrease the amount of taxes withheld and amounts to increase or decrease the amount of wage income subject. The American Opportunity Tax Credit is a partially refundable credit of up to 2500 per year for enrollment fees tuition course materials and other qualified expenses for your first.

How To Calculate Federal Withholding Tax Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

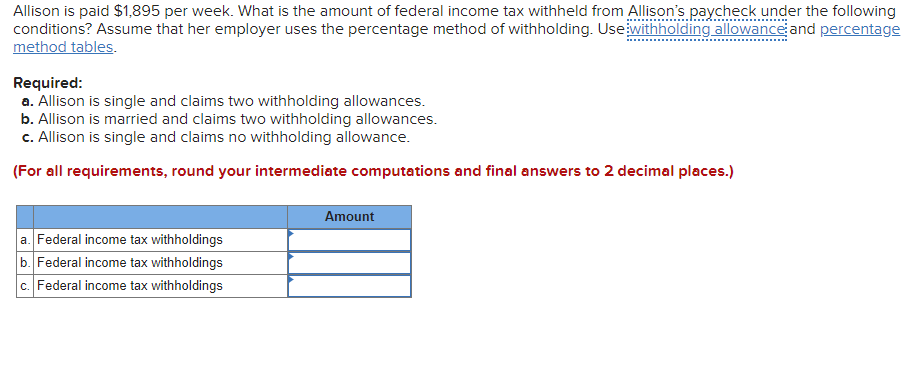

Solved Allison Is Paid 1 895 Per Week What Is The Amount Chegg Com

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

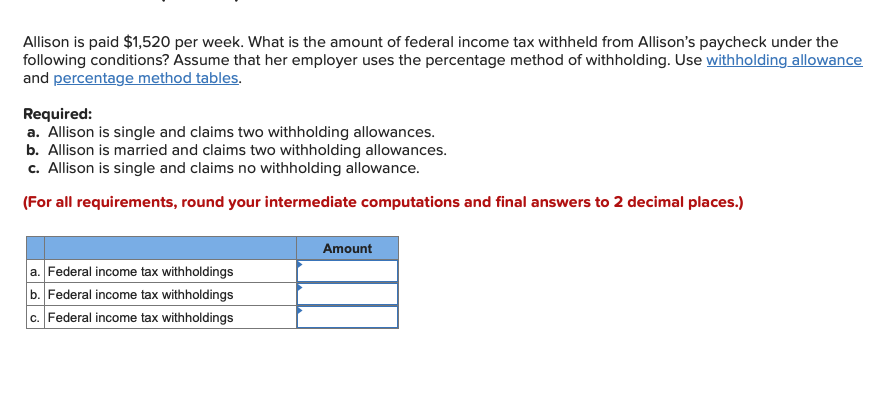

Solved Allison Is Paid 1 520 Per Week What Is The Amount Chegg Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Calculation Of Federal Employment Taxes Payroll Services

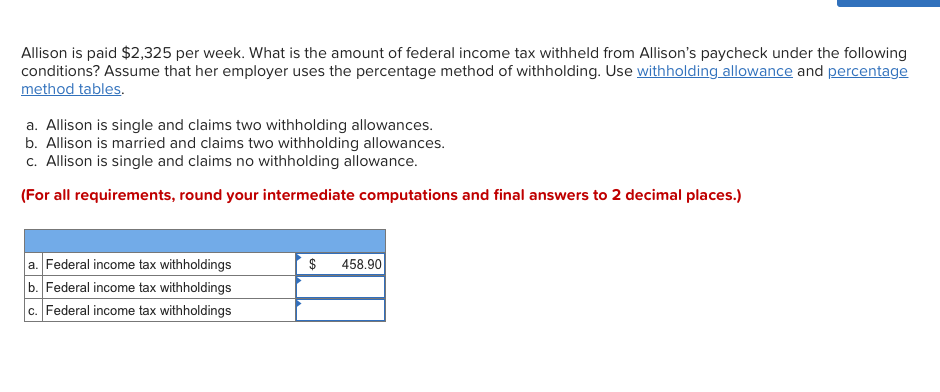

Solved Allison Is Paid 2 325 Per Week What Is The Amount Chegg Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Payroll Tax Vs Income Tax What S The Difference

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2019 Federal Income Withhold Manually

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Federal Income Tax

Solved Allison Is Paid 2 475 Per Week What Is The Amount Chegg Com

How To Calculate Federal Income Tax